945

17

Economics of Adaptation

Coordinating Lead Authors:

Muyeye Chambwera (Zimbabwe), Geoffrey Heal (USA)

Lead Authors:

Carolina Dubeux (Brazil), Stéphane Hallegatte (France), Liza Leclerc (Canada),

Anil Markandya (Spain), Bruce A. McCarl (USA), Reinhard Mechler (Germany/Austria),

James E. Neumann (USA)

Contributing Authors:

Patrice Dumas (France), Samuel Fankhauser (UK), Hans-Martin Füssel (Germany),

Alistair Hunt (UK), Howard Kunreuther (USA), Richard S.J. Tol (UK), Paul Watkiss (UK),

Richard Woodward (USA), David Zilberman (USA)

Review Editors:

Eduardo Calvo (Peru), Ana Iglesias (Spain), Stale Navrud (Norway)

Volunteer Chapter Scientist:

Terrence Kairiza (Zimbabwe)

This chapter should be cited as:

Chambwera

, M., G. Heal, C. Dubeux, S. Hallegatte, L. Leclerc, A. Markandya, B.A. McCarl, R. Mechler, and

J.E. Neumann, 2014: Economics of adaptation. In: Climate Change 2014: Impacts, Adaptation, and

Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment

Report of the Intergovernmental Panel on Climate Change [Field, C.B., V.R. Barros, D.J. Dokken, K.J. Mach,

M.D. Mastrandrea, T.E. Bilir, M. Chatterjee, K.L. Ebi, Y.O. Estrada, R.C. Genova, B. Girma, E.S. Kissel, A.N. Levy,

S. MacCracken, P.R. Mastrandrea, and L.L. White (eds.)]. Cambridge University Press, Cambridge, United

Kingdom and New York, NY, USA, pp. 945-977.

17

946

Executive Summary............................................................................................................................................................ 948

17.1. Background ............................................................................................................................................................. 950

17.2. Economic Aspects of Adaptation ............................................................................................................................ 950

17.2.1. Public and Private Actors in Adaptation Implementation .................................................................................................................. 950

17.2.2. Broad Categorization of Adaptation Strategies ................................................................................................................................ 950

17.2.3. Broad Definition of Benefits and Costs ............................................................................................................................................. 951

17.2.3.1. Ancillary Economic Effects of Adaptation Measures and Policies ...................................................................................... 951

17.2.3.2. Economic Consideration of Ancillary Effects ...................................................................................................................... 951

17.2.4. Adaptation as a Dynamic Issue ......................................................................................................................................................... 951

17.2.5. Practical Adaptation Strategy Attractiveness and Feasibility ............................................................................................................. 951

17.2.6. Adaptation Benefits and Costs, Residual Damage, and Projects ....................................................................................................... 952

17.2.7. A Broader Setting for Adaptation ..................................................................................................................................................... 953

17.2.7.1. Adaptation and Mitigation as Competitive or Complementary Investments ..................................................................... 954

17.2.7.2. Adaptation and Development ........................................................................................................................................... 954

17.3. Decision Making and Economic Context for Adaptation ........................................................................................ 954

17.3.1. Economic Barriers to Adaptation Decision Making ........................................................................................................................... 955

17.3.1.1. Transaction Costs, Information, and Adjustment Costs ...................................................................................................... 955

17.3.1.2. Market Failures and Missing Markets ................................................................................................................................ 955

17.3.1.3. Behavioral Obstacles to Adaptation .................................................................................................................................. 955

17.3.1.4. Ethics and Distributional Issues ......................................................................................................................................... 955

17.3.1.5 Coordination, Government Failures, and Political Economy ............................................................................................... 956

17.3.1.6. Uncertainty ........................................................................................................................................................................ 956

17.3.2. Economic Decision Making with Uncertainty .................................................................................................................................... 956

17.3.2.1. Cost-Benefit Analysis and Related Methods ...................................................................................................................... 956

17.3.2.2. Multi-Metric Decision Making for Adaptation ................................................................................................................... 957

17.3.2.3. Non-Probabilistic Methodologies ...................................................................................................................................... 957

17.4. Costing Adaptation ................................................................................................................................................. 958

17.4.1. Methodological Considerations ........................................................................................................................................................ 958

17.4.1.1. Data Quality and Quantity ................................................................................................................................................. 958

17.4.1.2. Costs and Benefits Are Location-Specific ........................................................................................................................... 958

17.4.1.3. Costs and Benefits Depend on Socioeconomics ................................................................................................................. 959

17.4.1.4. Discount Rates Matter ....................................................................................................................................................... 959

17.4.2. Review of Existing Global Estimates: Gaps and Limitations ............................................................................................................. 959

17.4.3. Consistency between Localized and Global Analyses ....................................................................................................................... 960

17.4.4. Selected Studies on Sectors or Regions ............................................................................................................................................ 960

Table of Contents

947

Economics of Adaptation Chapter 17

17

17.5. Economic and Related Instruments to Provide Incentives ..................................................................................... 963

17.5.1. Risk Sharing and Risk Transfer, Including Insurance .......................................................................................................................... 964

17.5.2. Payments for Environmental Services ............................................................................................................................................... 964

17.5.3. Improved Resource Pricing and Water Markets ................................................................................................................................ 964

17.5.4. Charges, Subsidies, and Taxes ........................................................................................................................................................... 965

17.5.5. Intellectual Property Rights .............................................................................................................................................................. 966

17.5.6. Innovation and Research & Development Subsidies ......................................................................................................................... 966

17.5.7. The Role of Behavior ......................................................................................................................................................................... 966

References ......................................................................................................................................................................... 966

Frequently Asked Questions

17.1: Given the significant uncertainty about the effects of adaptation measures, can economics

contribute much to decision making in this area? ............................................................................................................................ 954

17.2: Could economic approaches bias adaptation policy and decisions against the interests

of the poor, vulnerable populations, or ecosystems? ........................................................................................................................ 961

17.3: In what ways can economic instruments facilitate adaptation to climate change in developed and developing countries? ............ 965

948

Chapter 17 Economics of Adaptation

17

Executive Summary

In the presence of limited resources and a range of objectives, adaptation strategy choices involve trade-offs among multiple

policy goals (high confidence). The alternative policy goals include development and climate change mitigation. Economics offers valuable

insights into these trade-offs and into the wider consequences of adaptation. It also helps to explain the differences between the potential of

adaptation and its achievement as a function of costs, barriers, behavioral biases, and resources available. {17.2.7.1-2, 17.3.1}

Economic thinking on adaptation has evolved from a focus on cost-benefit analysis and identification of “best economic”

adaptations to the development of multi-metric evaluations including the risk and uncertainty dimensions in order to provide

support to decision makers (high confidence).

Economic analysis is moving away from a unique emphasis on efficiency, market solutions,

and cost-benefit analysis of adaptation to include consideration of non-monetary and non-market measures, risks, inequities and behavioral

biases, and barriers and limits and consideration of ancillary benefits and costs. One role of economics is to contribute information to decision

makers on the benefits and costs, including a number of non-monetary items, and on the equity impacts of alternative actions. It does not

provide a final ranking for policy makers. A narrow focus on quantifiable costs and benefits can bias decisions against the poor and against

ecosystems and those in the future whose values can be excluded or are understated. Sufficiently broad-based approaches, however, can help

avoid such maladaptation. Indeed the evidence shows that maladaptation is a possibility if the evaluation approaches taken are not

comprehensive enough in this sense. {17.2.3, 17.3.2}

The theoretical basis for economic evaluation of adaptation options is clear, and can be and has been applied to support decisions

in practical contexts (medium confidence). There is extensive experience of applying the concepts and methods underlying the economic

framework in non-adaptation contexts, which is useful for designing climate adaptation policies. The limited empirical evidence available

shows a number of cases where desirable adaptation strategies have been identified based on these economic tools. The findings show that

adaptation is highly regional and context specific. Thus the results do not readily permit widespread generalizations about the nature of

attractive adaptation actions. {17.2, 17.4.1-2, 17.4.4}

Both private and public sectors have a role to play in the development and implementation of adaptation measures (high

confidence).

Economic theory and empirical results show that a degree of adaptation will be autonomously carried out by private parties in

response to climate change. However, the private sector alone will often not provide the desirable level of adaptation with some types of actions

not undertaken due to costs, incentives, nature of beneficiaries, and resource requirements. This implies the public sector will need to play a

strong role. There are also other reasons for public action such as overcoming barriers, developing technologies, representing current and future

equity concerns, and other items. {17.2.1, 17.3.1}

The theory and the evidence indicate that adaptation cannot generally overcome all climate change effects (high confidence).

In addition to there being biophysical limits to adaptation, such as the inability to restore outdoor comfort under high temperatures, some

adaptation options will simply be too costly or resource intensive or will be cost ineffective until climate change effects grow to merit investment

costs. Thus the desirability of adaptation options will vary with time and climate change realization. {17.2.2, 17.2.5}

Adaptation generally needs to be seen in the frame of the overall development path of the country, particularly for developing

countries (high confidence).

Development and adaptation can be complementary or competitive. Also development can yield positive

ancillary adaptation effects or co-benefits, provided it takes into account climate change in its design. Adaptation actions can provide significant

co-benefits such as alleviating poverty or enhancing development. Many aspects of economic development also facilitate adaptation to a

changing climate, such as better education and health, and there are adaptation strategies that can yield welfare benefits even in the event of

a constant climate, such as more efficient use of water and more robust crop varieties. Maximizing these synergies requires a close integration

of adaptation actions with existing policies, referred to as “mainstreaming.” {17.2.7, 17.2.3.1-2}

Not all adaptation actions are investment-based. Policy actions are also important tools for adaptation (medium confidence).

These include direct research & development (R&D) funding, environmental regulation, economic instruments, and education. Economic

instruments have high potential as flexible tools because they directly and indirectly provide incentives for anticipating and reducing impacts

and can have lower costs in the public budget. These instruments are currently not well explored in an adaptation context apart from risk

949

17

Economics of Adaptation Chapter 17

financing instruments. Existing incentives will lead to a set of private adaptation actions. They include risk sharing and transfer mechanisms

(insurance), loans, public-private finance partnerships, payment for environmental services, improved resource pricing (water markets), charges

and subsidies including taxes, norms and regulations, and behavioral modification approaches. These instruments offer some useful possibilities

for addressing climate change but they also have problems of effective implementation that need to be addressed. The problems can be

particularly severe in developing countries. {17.4-5}

Risk financing mechanisms at local, national, regional, and global scales contribute to increasing resilience to climate extremes

and climate variability, but involve major design challenges so as to avoid providing disincentives, causing market failure and

worsening equity situations (medium confidence).

Mechanisms include insurance; reinsurance; micro insurance; and national, regional,

and global risk pools. The public sector often plays a key role as regulator, provider, or insurer of last resort. Risk financing can directly promote

adaptation through providing claim payments after an event and allow for improved decisions under risk pre-event (strong evidence). It can

also directly provide incentives for reducing risk, yet the evidence is weak and the presence of many counteracting factors often leads to

disincentives, which is known as moral hazard. {17.5.1}

Limited evidence indicates a gap between global adaptation needs and the funds available for adaptation (medium confidence).

There is a need for a better assessment of global adaptation costs, funding, and investment. Studies estimating the global costs of adaptation

are characterized by shortcomings in data, methods, and coverage (high confidence). {14.2, 17.4; Tables 17-2, 17-3}

Economics offers a range of techniques appropriate for conducting analysis in the face of uncertainties, and the choice of the

most appropriate technique depends on the nature of the problem and the nature and level of uncertainty (high confidence).

Uncertainty is unavoidable in analyses of adaptation to climate change because of lack of data, the efficacy of adaptation actions, and

uncertainties inherent in forecasting climate change. Approximate approaches are often necessary. There is a strong case for the use of economic

decision making under uncertainty, working with tools such as cost-benefit and related approaches that include time dimensions (real options

techniques), multi-metrics approaches, and non-probabilistic methodologies. There are methodologies that are able to capture non-monetary

effects and distributional impacts, and to reflect ethical considerations. {17.3.2.1-3}

Selected regional and sectoral studies suggest some core considerations and characteristics that should be included in the

economic analyses of adaptation (medium confidence). These desirable characteristics include a broad representation of relevant climate

stressors to ensure robust economic evaluation; consideration of multiple alternatives and/or conditional groupings of adaptation options;

rigorous economic analysis of costs and benefits across the broadest possible market and non-market scope; and a strong focus on support of

practical decision making that incorporates consideration of sources of uncertainty. Few current studies manage to include all of these

considerations. {17.4.3}

950

Chapter 17 Economics of Adaptation

17

17.1. Background

This chapter assesses the literature on the economics of climate change

adaptation, building on the Fourth Assessment Report (AR4) and the

i

ncreasing role that economic considerations are playing in adaptation

decision making and policy. AR4 provided a limited assessment of the costs

and benefits of adaptation, based on narrow and fragmented sectoral and

regional literature (Adger et al., 2007). Substantial advances have been

made in the economics of climate change adaptation after AR4.

The specific objectives involved in an adaptation effort can be diverse.

One may try to cancel all impacts (negative and positive), maintaining

the status quo. Alternatively one can try to cancel adverse impacts

and capture positive opportunities, so that the welfare gain (or loss) is

maximized (or minimized).

Part of the literature presents adaptation as a continuous, flexible

process, based on learning and adjustments (see, e.g., IPCC, 2012).

Adaptation projects informed by this approach emphasize learning and

experimenting, plus the value of using reversible and adjustable strategies

(Berkhout et al., 2006; McGray et al., 2007; Pelling et al., 2007; Leary et

al., 2008; Hallegatte, 2009; Hallegatte et al., 2011c).

Adaptation action and policy has also advanced since AR4, and the

literature on the economics of adaptation has reflected this. This chapter

builds on other chapters in this assessment—in particular Chapter 2,

which sets the basis for decision making, recognizing economics as a

decision support tool for both public and private actors. The type of

economic approach used depends on factors discussed in Chapter 2,

among others, including the agent making the decision, the nature or

type of decision, the information used to make the decision, who

implements the decision, others affected by the outcomes, and the

values attached to those outcomes. While realizing the linkages

between adaptation and mitigation, the starting point of this chapter

is that adaptation is a given need.

This chapter assesses the scientific literature covering the economic

aspects of adaptation; decision making and the economic context of

adaptation, including economic barriers to adaptation decision making,

and uncertainty; costing adaptation; and the economic and related

instruments to provide incentives for adaptation.

17.2. Economic Aspects of Adaptation

When considering adaptation, economic studies give insight into issues

regarding the roles of various actors in society, the character of

adaptation strategies, the types of benefits and costs involved, the role

of time, and a number of other factors that we discuss in this section.

17.2.1. Public and Private Actors in

Adaptation Implementation

Previous IPCC reports—i.e., the Third Assessment Report (TAR) and

First Assessment Report (FAR)—indicate adaptation actions can be

a

utonomous, planned, or natural. Autonomous actions are undertaken

mostly by private parties while planned can be undertaken by private

or public actors. Natural adaptation is that occurring within the ecosystem

in reaction to climate change but may be subject to human intervention

(see discussion in Section 14.1).

In terms of human actions there are important economic distinctions

regarding the roles of private and public actors. Some adaptation

actions create public goods that benefit many and in such cases the

implementing party cannot typically capture all the gains. For example,

if an individual pays to protect a coastline or develop an improved

irrigation system, the gains generally go to many others. Classical economic

theory (Samuelson, 1954) and experience plus observations regarding

adaptation (Mendelsohn, 2000; Osberghaus et al., 2010a; Wing and Fisher-

Vanden, 2013) indicate that such actions will not receive appropriate

levels of private investment (creating a market failure). In turn, this calls

for public action by elements of broader society (e.g., governments, non-

governmental organizations (NGOs), or international organizations).

Other reasons for public provision or public regulation of certain adaptation

measures that lead to less than a socially desirable level of adaptation

are discussed in Section 17.3.

17.2.2. Broad Categorization of Adaptation Strategies

There are many possible adaptation measures, as indicated in the TAR

and FAR, plus Chapters 14 and 15. In economic terms these include a

mixture of public and private actions taken in both domestic and

international settings. A broad characterization of these and who might

undertake them follows:

• Altered patterns of enterprise management, facility investment,

enterprise choice, or resource use (mainly private)

• Direct capital investments in public infrastructure (e.g., dams and

water management—mainly public)

• Technology development through research (e.g., development of

crop varieties—private and public)

• Creation and dissemination of adaptation information (through

extension or other communication vehicles—mainly public)

• Human capital enhancement (e.g., investment in education—

private and public)

• Redesign or development of adaptation institutions (e.g., altered

forms of insurance—private and public)

• Changes in norms and regulations to facilitate autonomous actions

(e.g., altered building codes, technical standards, regulation of

grids/networks/utilities, environmental regulations—mainly public)

• Changes in individual behavior (private, with possible public

incentives)

• Emergency response procedures and crisis management (mainly

public).

Not all adaptation involves investment or is costly. Some adaptation

measures involve modification of recurring expenditures as opposed to

new investments (replacing depreciated equipment with more adapted

items). Sometimes adaptation involves changes in behaviors and

lifestyles (e.g., due to increased frequency of heat waves).

951

17

Economics of Adaptation Chapter 17

17.2.3. Broad Definition of Benefits and Costs

The consequences of adaptation decisions cannot be expressed

comprehensively through standard economic accounting of costs and

revenues. Adaptation decisions can also affect other items such as

income distribution and poverty (Jacoby et al., 2011); the regional

distribution of economic activity, including employment; non-market

factors such as water quality, ecosystem function, and human health;

and social organization and cultural practices.

Adaptation choices have broad ranging and complex impacts on such

issues as:

• Macroeconomic performance (see, e.g., Fankhauser and Tol, 1995)

• Allocation of funds with a crowding out effect on other climate and

non-climate investments with consequences for future economic

growth (Hallegatte et al., 2007; Hallegatte and Dumas, 2008; Wang

and McCarl, 2013)

• Welfare of current and future generations through resource availability

and other non-monetary effects

• Risk distributions on all of the above due to routine variability plus

uncertain estimates of the extent of climate change and adaptation

benefits and costs.

A number of these items pose challenges for measurement and certainly

for monetization. Generally this implies that any analysis be multi-metric,

with part in monetary terms and other parts not, and some in precise

quantitative terms and others not (for more discussion see Section

17.3). In view of this, it is reasonable to conclude that an unbiased,

comprehensive analysis would consist of a multi-metric analysis

encompassing cost-benefit and other monetary items plus non-monetary

measures. That analysis would support adaptation decision making.

17.2.3.1. Ancillary Economic Effect

of Adaptation Measures and Policies

In addition to creating an economy that is more resilient to the effects

of climate change, adaptation strategies often have ancillary effects of

substantial importance. These can be positive (co-benefits) or negative

(co-costs). Ancillary effects also arise when actions aimed primarily at

mitigation or non-climate-related matters alter climate adaptation.

Examples include:

• Sea walls that protect against sea level rise and at the same time

protect against tsunamis. However, they can have co-costs causing

damages to adjacent regions, fisheries, and mangroves (Frihy, 2001).

• Crop varieties that are adapted to climate change have enhanced

resistance to droughts and heat and so also raise productivity in

non-climate change-related droughts and temperature extreme

(Birthal et al., 2011).

• Better building insulation that mitigates energy use and associated

greenhouse gas emissions also improves adaptation by protecting

against heat (Sartori and Hestnes, 2007).

• Public health measures that adapt to increases in insect-borne

diseases also have health benefits not related to those diseases

(Egbendewe-Mondzozo et al., 2011).

• More efficient use of water—adaptation to a drier world—will

also yield benefits under current conditions of water scarcity.

D

evelopment of improved desalination methods has the same

merits (Khan et al., 2009).

• Locating infrastructure away from low-lying coastal areas provides

adaption to sea level rise and will also protect against tsunamis.

• Reducing the need to use coal-fired power plants through energy

conserving adaptation will also provide mitigation, improve air

quality, and reduce health impacts (Burtraw et al., 2003).

17.2.3.2. Economic Consideration of Ancillary Effects

Many studies argue that co-benefits should be factored into decision

making (e.g., Brouwer and van Ek, 2004; Ebi and Burton, 2008; Qin et

al., 2008; de Bruin et al., 2009a; Kubal et al., 2009; Viguie and Hallegatte,

2012). If a country has a fixed sum of money to allocate between two

competing adaptation projects, and both strategies generate net positive

ancillary effects, then the socially optimal allocation of adaptation

investment will differ from the private optimum and will favor the

activity with the larger direct plus ancillary effects.

17.2.4. Adaptation as a Dynamic Issue

Adaptation is not a static concern. Rather it evolves over time in response

to a changing climate (Hallegatte, 2009). Adaptation is perhaps best

handled via a long-term transitional, continuous, flexible process that

involves learning and adjustment (Berkhout et al., 2006; McGray et al.,

2007; Pelling et al., 2007; Leary et al., 2008; Hallegatte, 2009; Hallegatte

et al., 2011c; IPCC, 2012). Generally the literature indicates that optimal

adaptation and the desirability of particular strategies will vary over

time depending on climate forcing plus other factors such as technology

availability and its maturity (de Bruin et al., 2009b). In the next few

decades, during which time projected temperatures do not vary

substantially across socioeconomic/climate scenarios, adaptation is the

main economic option for dealing with realized climate change. Risk is

also an important aspect, with the longer term being more uncertain

that the near term. Risk-sensitive decisions often include the options of

acting or of waiting (Linquiti and Vonortas, 2012). The issue of options

is discussed further in Beltratti et al. (1998), which covers uncertainty

about future preferences through option values.

Dynamics also are involved with strategy persistence owing to the

decadal to century time scale implications of some adaptation strategies

such as construction of seawalls or discovery of drought-resistant crop

genes. The desirability of investments with upfront costs and persistent

benefits increases when the benefits are long lasting or when climate

change damages accumulate slowly (Agrawala et al., 2011; de Bruin,

2011; Wang and McCarl, 2013). However, maladaptation effects rising

over time are also possible as protecting now can expand investment

in vulnerable areas and worsen future vulnerability (Hallegatte, 2011).

17.2.5. Practical Adaptation Strategy

Attractiveness and Feasibility

Adaptation cannot reasonably overcome all climate change effects

(Parry et al., 2009). A number of factors will limit strategy adoption and

952

Chapter 17 Economics of Adaptation

17

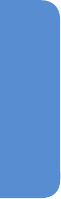

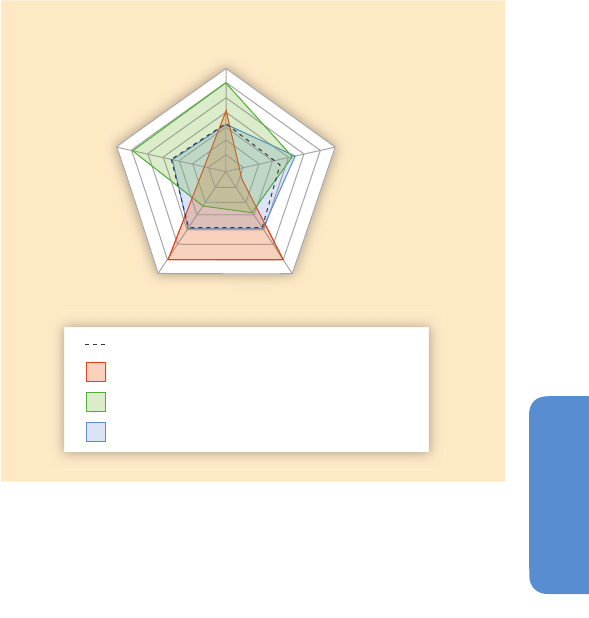

preclude elimination of all climate change effects. A conceptual way of

looking at this for a given adaptation endeavor is in Figure 17-1. The

first outside circle represents the “adaptation needs,” that is, the set of

adaptation actions that would be required to avoid any negative effect

(and capture all positive effects) from climate change. It can be reduced

by climate change mitigation, that is, by limiting the magnitude of

climate change. The second circle represents the subset of adaptation

actions that are possible considering technical and physical limits.

Improving what can be done, for instance, through research and

development, can expand this circle. The area between the first and

second circles is the area of “unavoidable impacts” that one cannot

adapt to (for instance, it is impossible to restore outdoor comfort under

high temperature). The third circle represents the subset of adaptation

actions that are desirable considering limited resources and competing

priorities: some adaptation actions will be technically possible, but

undesirable because they are too expensive and there are better

alternative ways of improving welfare (e.g., investing in health or

education). This circle can be expanded through economic growth,

which increases resources that can be dedicated to adaptation. Finally,

the last circle represents what will be done, taking into account the fact

that market failures or practical, political, or institutional constraints will

make it impossible to implement some desirable actions (see Chapter

15 and Section 17.3). The area between the first and the last circles

represents residual impacts (i.e., the impacts that will remain after

adaptation, because adapting to them is impossible, too expensive, or

impossible owing to some barriers).

This discussion has consequences for timing of adaptation financing,

given continuous changes in climate over time and uncertainties in the

resulting impacts. Mathew et al. (2012) recommend the use of soft,

short-term and reversible adaptation options with co-benefits for local

governments. Giordano (2012) recommends the use of adaptive policies

for modifying infrastructure, which can be robust across a wide range

of plausible futures under climate change. Hochrainer and Mechler

(2011) suggest that tools such as risk pooling may be more cost effective

t

han risk reduction through engineering methods for low-frequency but

high-impact hazards.

Financing adaptation programs is further discussed in the literature

through the lens of distribution of costs. Stern (2006) argues climate

change is characterized by a “double inequity,” with those countries

that are most vulnerable having generally contributed least (on a per

capita basis) to the climate change drivers (Panayotou et al., 2002; Tol

et al., 2004; Mendelsohn et al., 2006; Patz et al., 2007; SEGCC, 2007;

Srinivasan et al., 2008; Füssel, 2010).

Distribution of responsibilities for financing adaptation has been the

subject of lively debate. Füssel et al. (2012) note that answering the

following questions can inform the debate on such burden sharing

issues:

• Who pays for adaptation and how much should they contribute

into the adaptation fund, and what criteria are appropriate in

determining this?

• Who is eligible for receiving payments from the fund, and which

criteria could be used for prioritizing recipients and for allocating

funds?

• Which adaptation measures are eligible for funding, and what are

the conditions and modalities for payment?

• How and by whom are such decisions made?

As of now no definitive conclusions have been reached. Table 17-1 sets

out different approaches to defining eligibility for receiving adaptation

funds.

17.2.6. Adaptation Benefits and Costs,

Residual Damage, and Projects

Adaptation benefits are the reduction in damages plus any gains in

climate-related welfare that occur following an adaptation action

(National Research Council, 2010; World Bank, 2010a). Simplistically

described, the cost of adaptation is the cost of any additional investment

needed to adapt to or exploit future climate change (UNFCCC, 2007).

But a full accounting needs to consider the resources spent to develop,

W

h

a

t

i

s

s

u

g

g

e

s

t

e

d

W

h

a

t

w

e

c

a

n

d

o

W

h

a

t

w

e

w

a

n

t

t

o

d

o

What we

will do

Implementation

constraints

A

d

a

p

t

a

t

i

o

n

s

p

a

c

e

T

e

c

h

n

i

c

a

l

a

n

d

p

h

y

s

i

c

a

l

l

i

m

i

t

s

O

b

j

e

c

t

i

v

e

s

Figure 17-1 | The narrowing of adaptation from the space of all possible

adaptations to what will be done. Forces causing the narrowing are listed in black.

Motivation

for action

Relevant climatic factors

Observed and /or

projected climate change

Climate change as well as

natural climate variability

Climate is the

main reason

Defi nition 1: Action occurs

mainly to reduce the risks of

observed or projected climate

change.

Example: Raising of existing

dykes.

Defi nition 2: Action occurs

mainly to reduce risks of climate

change and climate variability.

Example: Building of new dykes

in areas that are currently

unprotected.

Climate is one of

several reasons

Defi nition 3: Actions that

reduce the risks of observed or

projected climate change even

if they are also justifi ed in the

absence of climate change.

Example: Economic

diversifi cation in predominantly

agricultural regions.

Defi nition 4: Actions that reduce

the risks of climate change and

climate variability even if they

are also justifi ed in the absence

of climate change.

Example: Improved public health

services.

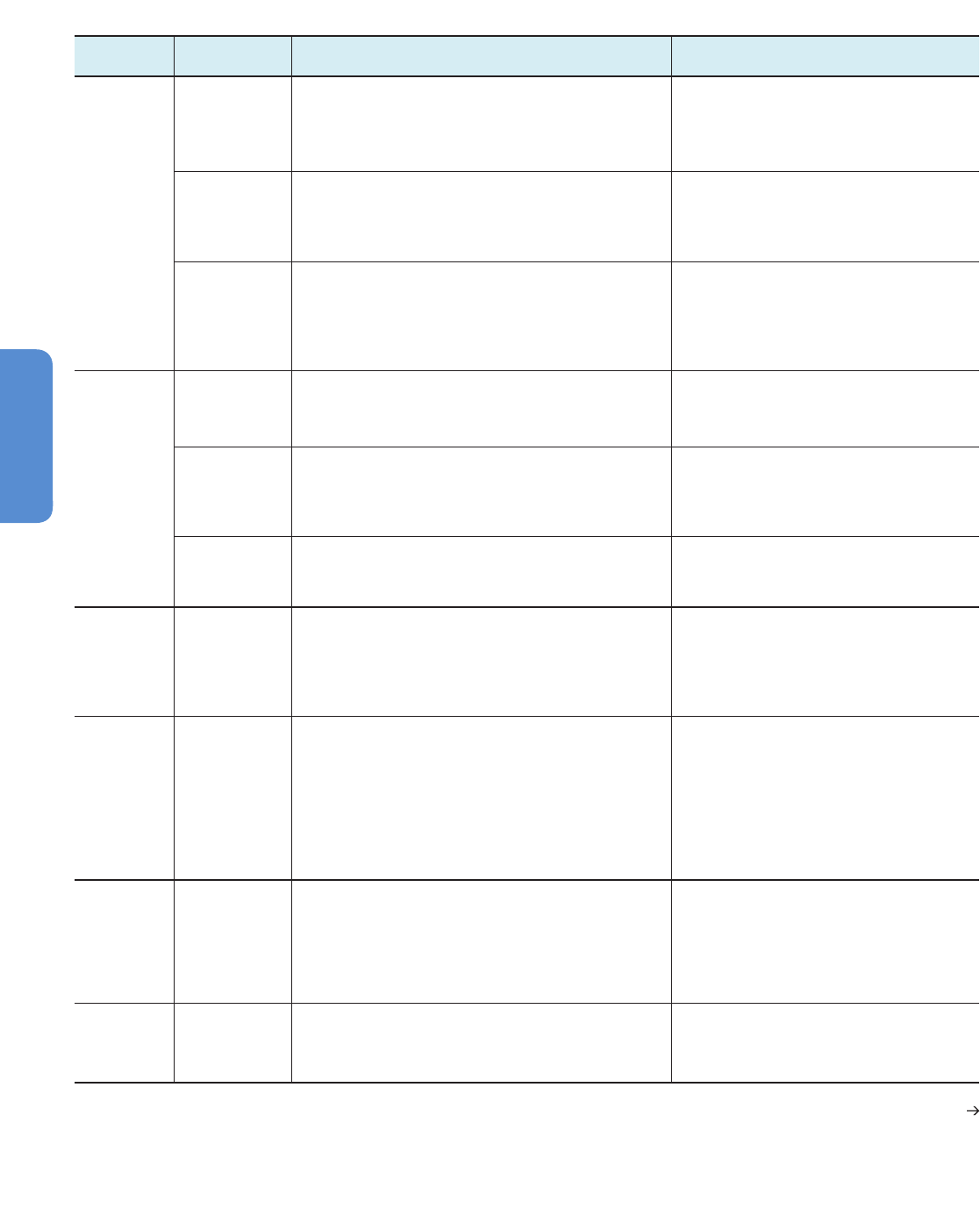

Table 17-1 | Four defi nitions of eligible adaptation.

Source: Füssel et al. (2012), adapted from Hallegatte (2008).

953

17

Economics of Adaptation Chapter 17

i

mplement, and maintain the adaptation action along with accruing

reduced damages or welfare increases involving monetary and non-

monetary metrics.

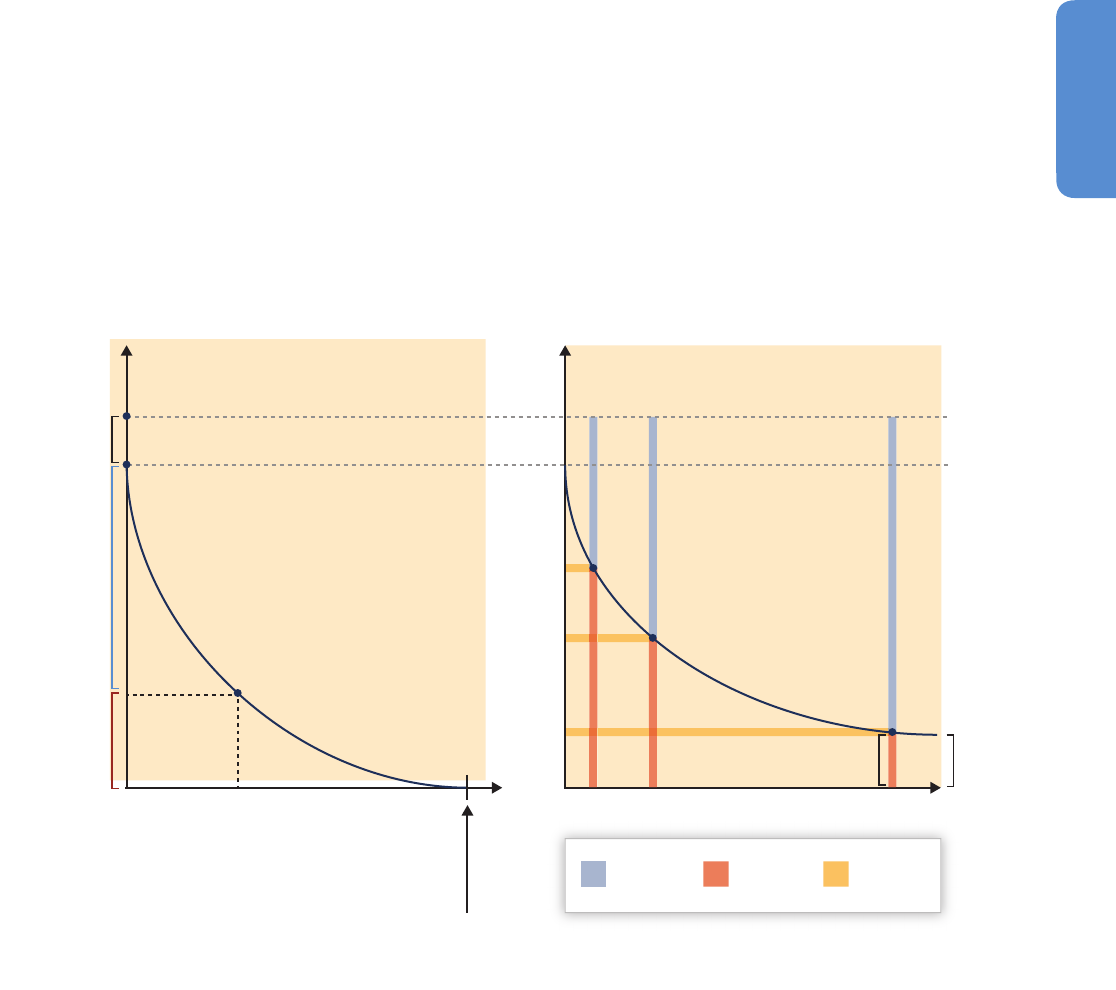

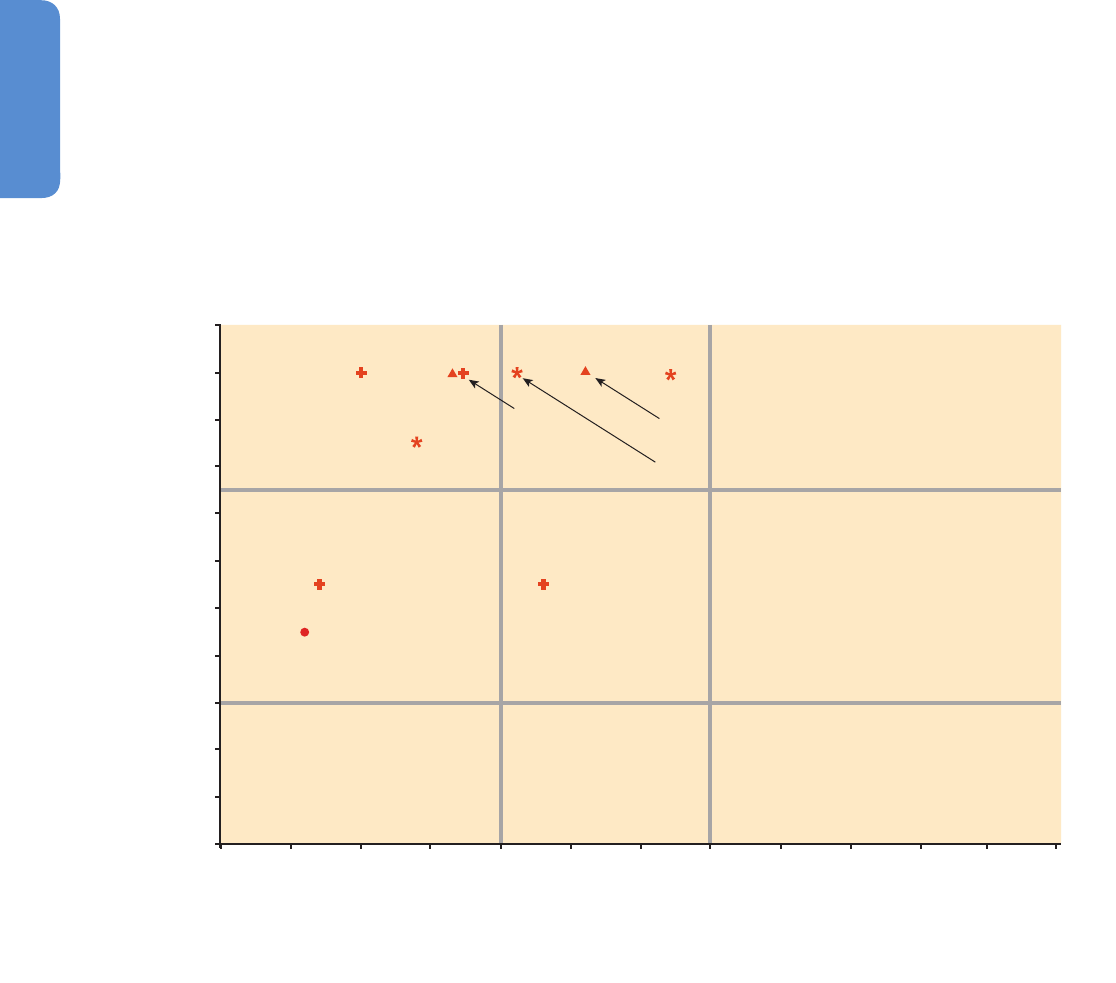

Figure 17-2 provides a graphical representation of the link between the

cost of adaptation (on the x-axis) and the residual cost of climate

change (on the y-axis). A fraction of climate change damage can be

reduced at no cost (e.g., by changing sowing dates in the agricultural

sector). With increasing adaptation cost, climate change costs can be

reduced further. In some cases (left-hand panel), sufficiently high

adaptation spending can take residual cost to zero. In other cases (right-

hand panel), some residual cost of climate change is unavoidable.

Economics tells that the optimal level of adaptation equalizes the

marginal adaptation cost and the marginal adaptation benefit, given

by the point on the adaptation curves where the slope is –45°. If barriers

and constraints (see Section 17.3) impose a suboptimal situation, the

marginal costs and benefits of adaptation are not equal, possibly

because there is too much investment in adaptation, so that investing

$1 in adaptation reduces climate change residual cost by less than $1,

or because there is not enough investment in adaptation and investing

$1 more in adaptation would reduce residual cost by more than $1 (the

situation in the right-hand panel).

Defining the costs and benefits of an “adaptation project” raises

conceptual issues. Many actions have an influence on the impact of

climate change without being adaptation projects per se (e.g., enhanced

building norms). Many “adaptation projects” have consequences beyond

a reduction in climate change impacts or an increase in welfare from

e

xploiting opportunities (as discussed in the ancillary impacts section).

Defining the adaptation component requires the definition of a baseline

(What would be the impact of climate change in the absence of the

adaptation action? What alternative projects would be implemented in

the absence of climate change?), and the definition of “additionality”—

the amount of additional loss reduction or welfare gain that happens

because of the project. For instance, the building of new infrastructure

may be marginally more costly because of adaptation to climate change

but would still be undertaken without climate change and thus only a

fraction of that cost and the resultant benefits would be labeled as

occurring because of adaptation (see Dessai and Hulme, 2007).

In the climate change context, residual damages are those damages

that remain after adaptation actions are taken. De Bruin et al. (2009b)

and Hof et al. (2009) have examined the relationship between increasing

adaptation effort and diminished residual damages.

17.2.7. A Broader Setting for Adaptation

Adaptation can be complementary to mitigation and to non-climate

policies. An important concern is determining the balance between

spending on adaptation versus that on other investments—mitigation

and non-climate endeavors. Economics indicates the marginal social

returns to all forms of expenditure should be the same, allowing for

distributional impacts which can be done by differential weightings of

benefits and costs to alternative income groups (Musgrave and Musgrave,

1973; Brent, 1996).

Cost of climate change

Adaptation cost

Free

adaptation

Technology limits

(”What we can do” in Figure 17-1)

Optimal balance between adaptation

costs and residual impacts

When full adaptation is possible When full adaptation is not possible

Cost of climate change (no adaptation)

Residual

costs/impacts

Avoided

impacts

Cost of adaptation

(to avoid all impacts)

Suboptimal balance with imperfection

(”What we will do” in Figure 17-1)

Optimal balance

(”What we want to do” in Figure 17-1)

Costs that

cannot be

avoided by

adaptation

Adaptation cost

Cost of climate change

Avoided

impacts

Residual

impacts

Adaptation

costs

Figure 17-2 | Graphical representation of link between the cost of adaptation (on the x-axis) and the residual cost of climate change (on the y-axis). The left panel represents a

case where full adaptation is possible, while the right panel represents a case in which there are unavoidable residual costs.

954

Chapter 17 Economics of Adaptation

17

17.2.7.1. Adaptation and Mitigation as

Competitive or Complementary Investments

Adaptation and mitigation funding require coordination as they are

competing uses for scarce resources (WGII AR4 Chapter 18; Gawel et al.,

2012). They also compete with consumption and non-climate investments.

For example, some adaptation strategies use land (a shift from crops to

livestock), as does mitigation via afforestation or biofuels, and all three

would reduce ongoing crop production. Nevertheless, considering both

adaptation and mitigation widens the set of actions and lowers the

total cost of climate change (de Bruin et al., 2009a; Koetse and Rietveld,

2012; Wang and McCarl, 2013).

17.2.7.2. Adaptation and Development

There is a relationship between adaptation and socioeconomic

development, particularly in lower income countries (as extensively

discussed in Chapters 10, 13, and 20). In terms of complementarity

between the two, studies show that both development and adaptation

can be enhanced via climate-resilient road development (World Bank,

2009); installation of agricultural investments that enhance income,

heat tolerance, and drought resilience (Butt et al., 2006;Ringer et al.,

2008); or improvements in public health infrastructure that increase

c

apability to deal with climate-enhanced disease and other diseases

(Markandya and Chiabai, 2009; Samet, 2010). In addition, development

in general can increase adaptive capacity through enhancements in

human and other capital (Schelling, 1992, 1997; Tol, 2005; IPCC, 2012).

Finally, adaptation efforts may reduce adaptation deficits regarding

vulnerability to existing climate and enhance general development

(Burton, 2004). Thus, development goals can be generally consistent

with adaptation goals, with one possibly being an ancillary effect of

the other, although this is not always the case. For example, Hansone

et al. (2001) find that urbanization of flood-prone areas increases

vulnerability and adaptation needs while Burby et al. (2001) and

Hallegatte (2012) indicate better protection may trigger additional

development in at-risk areas and create increased vulnerability to

extreme events.

17.3. Decision Making and

Economic Context for Adaptation

Adaptation will be carried out by multiple public and private actors who

face a number of decision-making barriers that may limit adaptation.

Chapter 16 and many papers (e.g., Fankhauser et al., 1999; Cimato and

Mullan, 2010; Moser and Eckstrom 2010; Biesbroek et al., 2011;

Fankhauser and Soare, 2013) investigate these barriers. This section

Frequently Asked Questions

FAQ 17.1 | Given the significant uncertainty about the effects of adaptation measures, can

economics contribute much to decision making in this area?

Economic methods have been developed to inform a wide range of issues that involve decision making in the face

of uncertainty. Indeed some of these methods have already been applied to the evaluation of adaptation measures,

such as decisions on which coastal areas to protect and how much to protect them.

A range of methods can be applied, depending on the available information and the questions being asked. Where

probabilities can be attached to different outcomes that may result from an adaptation measure, economic tools

such as risk and portfolio theory allow us to choose the adaptation option that maximizes the expected net benefits,

while allowing for the risks associated with different options. Such an approach compares not only the net benefits

of each measure but also the risks associated with it (e.g., the possibility of a very poor outcome).

In situations where probabilities cannot be defined, economic analysis can define scenarios that describe a possible

set of outcomes for each adaptation measure that meet some criteria of minimum acceptable benefits across a

range of scenarios, allowing the decision maker to explore different levels of acceptable benefits in a systematic

way. That, of course, hinges on the definition of “acceptability,” which is a complex matter that accounts for

community values as well as physical outcomes. These approaches can be applied to climate change impacts such

as sea level rise, river flooding, and energy planning.

In some cases it is difficult to place specific economic values on important outcomes (e.g., disasters involving large-

scale loss of life). An alternative to the risk or portfolio theory approach can then be used, that identifies the least-

cost solution that keeps probable losses to an acceptable level.

There are, however, still unanswered questions on how to apply economic methods to this kind of problem

(particularly when the changes caused by climate change are large and when people’s valuations may be changed),

and on how to improve the quality of information on the possible impacts and benefits.

955

17

Economics of Adaptation Chapter 17

r

eviews them from an economic perspective, and then turns to the

decision-making frameworks that can help implement adaptation

actions in spite of these barriers.

17.3.1. Economic Barriers to Adaptation Decision Making

1

7.3.1.1. Transaction Costs, Information, and Adjustment Costs

Transaction costs include the costs of accessing markets and information,

along with reaching an agreement and enforcement costs (Coase, 1937,

1960; Williamson, 1979). Because of transaction costs, a beneficial

adaptation action may be undesirable. Two specific types of transaction

costs are those relating to information and those relating to adjustment.

Information acquisition costs can represent a significant obstacle, for

instance, when climate and weather data are costly or difficult to access

(e.g., Cimato and Mullan, 2010; Ford et al., 2011; Scott et al., 2011).

Because information is a public good, private actors tend to under-

provide it and there is a role for government and public authorities to

support its production and dissemination (e.g., through research funding,

observation networks, or information distribution systems; Fankhauser

et al., 1999; Mendelsohn, 2000; Trenberth, 2008).

Adjustment costs represent another barrier, especially in the presence

of uncertainty and learning, and when long-lived capital is concerned.

Fankhauser et al. (1999) discuss adjustment costs as a barrier to early

capital replacement to adapt to a different climate. Kelly and Kolstad

(2005) define adjustment costs as the cost incurred while learning about

new climate conditions. Using these different definitions, these analyses

suggest that adjustment costs can represent a significant share of

adaptation costs.

17.3.1.2. Market Failures and Missing Markets

Adaptation may also face market failures such as externalities,

information asymmetry, and moral hazards (see Section 17.2.1;

Osberghaus et al., 2010a). As a consequence, some socially desirable

actions may not be privately profitable. For example, flood mitigation

measures may not be implemented in spite of their benefits, when flood

risks are partly assumed by insurance or post-disaster support,

transferring risk to the community (a case of moral hazard; Burby et al.,

1991; Laffont, 1995). There are also externalities, as adaptation actions

by one household, firm, or even country may create higher damages for

others. This is the case with transboundary waters, when increased

irrigation in one country creates water scarcity downstream (Goulden

et al., 2009). Trans-sector effects can also take place, for instance when

adaptation in one sector creates needs in another sector (e.g., the

impact on transportation of agriculture adaptation; see Attavanich et

al., 2013). Incentives for private adaptation actions may also be lacking

for public goods and common resources without property rights (e.g.,

biodiversity and natural areas, tradition, and culture). And adaptation

may exhibit increasing returns or large fixed costs, leading to insufficient

adaptation investments (e.g., Eisenack, 2013). In such contexts, public

norms and standards, direct public investment, tax measures, or national

o

r international institutions for adaptation coordination are needed to

avoid maladaptation.

17.3.1.3. Behavioral Obstacles to Adaptation

Economic agents adapt continuously to climate conditions, though not

always using the available information, especially long-term projections

of consequences (Camerer and Kunreuther, 1989; Thaler, 1999; Michel-

Kerjan, 2006). Individuals often defer choosing between ambiguous

choices (Tversky and Shafir, 1992; Trope and Lieberman, 2003) and make

decisions that are time inconsistent (e.g., they attribute a lower weight

to the long term through “hyperbolic discounting”; see Ainslie, 1975).

They also systematically favor the status quo and familiar choices

(Johnson and Goldstein, 2003). Also, individuals value profits and losses

differently (Tversky and Kahnman, 1974). Behavioral issues may lead

to suboptimal adaptation decisions, as illustrated with case studies in

Germany and Zimbabwe in Grothmann and Patt (2005). Particularly

important is the fact that the provision of climate information needs to

account for cognitive failures (Suarez and Patt, 2004; Osberghaus et al.,

2010b). Individual behavioral barriers extend to cultural factors and

social norms, which can support or impair adaptation as illustrated by

Nielsen and Reenberg (2010) in Burkina Faso.

17.3.1.4. Ethics and Distributional Issues

A difficulty in allocating adaptation resources noted in Section 17.2.3

is the limitation of indicators based on costs and benefits (Adger et al.,

2005; Füssel, 2010). Outcomes are often measured using such methods

but their limits are well known, (e.g., CMEPSP, 2009; OECD, 2009; Heal,

2012) and include the failure to take into account resource depletion,

environmental change, and distributional issues.

Distributional issues may justify public intervention based on ethics and

values. Climate change impacts vary greatly by social group, and many

have suggested that the poor are particularly vulnerable (e.g., Stern,

2006; Füssel et al., 2012). Some individuals, firms, communities, and

even countries may be unable to afford adaptation, even if it is in their

own interest. Also, individuals with different world views or preferences

(e.g., regarding risk aversion; see Adger et al., 2009) may ask for different

adaptation measures and have different views of what is an acceptable

level of residual risk (Peters and Slovic, 1996). Consideration of justice

and fairness will play a role in adaptation option design (Adger et al.,

2006; Brauch, 2009a,b; Dalby, 2009; O’Brien et al., 2009, 2010; Pelling

and Dill, 2009). The implementation of adaptation options may thus

require taking into account the political economy of reforms and the

need to compensate losers (World Bank, 2012).

The traditional economic approach suggests choosing the most cost-

effective projects and then resorting to financial transfers to satisfy

equity objectives (Atkinson and Stiglitz, 1976; Brown and Heal, 1979).

However, this embodies strong assumptions including the ability to

realize perfect and costless financial transfers. In more realistic

situations the choice is not so clear cut. In practical terms, transfers are

difficult to organize and may not be politically acceptable (Kanbur, 2010).

956

Chapter 17 Economics of Adaptation

17

I

n these cases, adaptation decision making needs to account for both

the net benefits and the impacts on equity (Aakre and Rübbelke, 2010).

17.3.1.5 Coordination, Government Failures,

and Political Economy

One of the main roles of governments and local authorities is to remove

barriers—realigning the incentives of individuals with the goals of

society, providing the public goods needed for adaptation, or helping

with behavioral and cognitive biases. But governments and local

authorities face their own barriers, often referred to as government or

regulatory failures (Krueger, 1990). First, government and local authority

decision makers, as individuals, face their own barriers, such a cognitive

and behavioral biases (Podsakoff et al., 1990). Public decision makers

are also confronted with moral hazard, for instance, when subnational

entities are provided support from the government in case of disaster

(Michel-Kerjan, 2006). Second, governments may have access to

insufficient resources or limited adaptation capacity, especially in

poorer countries and where governments have limited access to capital

markets and are unable to fund projects, even when they are cost

efficient (e.g., Brooks et al., 2005; Smit and Wandel, 2006; World Bank,

2012). There can also be coordination failures within the government,

as many adaptation options require multi-ministry actions (e.g., the

reduction of flood risks may require some prevention measure

implemented by the environmental ministry and an insurance scheme

regulated by the ministry of finance; World Bank, 2013).

Other government failures can arise. Frequently government action is

driven by narrow interest groups and is not in the public interest (Levine

and Forrence, 1990; James, 2000). Multi-stakeholder approaches have

been shown to help address these problems, with a relevant example

for this context being coral reef management in Tobago (Adger et al.,

2005).

17.3.1.6. Uncertainty

Decisions about adaptation have to be made in the face of uncertainty

on items ranging from demography and technology to economic futures.

Climate change adds additional sources of uncertainty, including

uncertainty about the extent and patterns of future climate change (see

the WGI contribution to the AR5), which is dependent on uncertain

socioeconomic development pathways and climate policies (see the

WGIII contribution to the AR5), and uncertainty about the reaction and

adaptation of ecosystems (see Chapters 3 to 13).

Patt and Schröter (2008) show in a case study in Mozambique that

major uncertainties are a strong barrier to successful adaptation.

Uncertainty, coupled with the long lifespan of a number of options, can

lead to “maladaptation,” that is, an adaptation action that leads to

increased vulnerability. An “avoidable” maladaptation arises from a

poorex ante choice, where available information is not used properly.

An “unavoidable” ex post maladaptation can result from entirely

appropriate decisions based on the information that was the best

availableat the time of decision making, but subsequently proves to

have been wrong. An example of the latter is a precautionary restriction

p

rohibiting new construction in areas potentially at risk of sea level rise.

Applying such a precautionary approach makes sense when (1) decisions

are at least partly irreversible (e.g., building in flood-prone areas cannot

easily be “un-built”) and (2) the cost of a worst-case scenario is very

high. Such a precautionary measure can make economic senseex ante,

even if sea level rise eventually remains in the lower range of possible

outcomes, making the construction restriction unnecessary.

17.3.2. Economic Decision Making with Uncertainty

Decision making under uncertainty is a central question for climate

change policy and is discussed in many chapters of the AR5, especially in

Chapter 2 and WGIII AR5 Chapters 2 and 3. This section focuses on the

economic approaches to decision making under uncertainty, including

decision-making techniques, valuation tools, and multi-metric decision

making.

17.3.2.1. Cost-Benefit Analysis and Related Methods

There are different tools for decision making that can be applied in

different contexts and with different information. Cost-benefit analysis

under uncertainty applied to adaptation uses subjective probabilities

for different climate futures (e.g., Tebaldi et al., 2005; New and Hulme,

2006; see also Chapter 2). The “best” project is the one that maximizes

the expected net present value of costs and benefits. Risk aversion can

be taken into account through (nonlinear) welfare functions or the

explicit introduction of a risk premium.

When conducting cost-benefit analyses under uncertainty, an important

question is the timing of action, that is, the possibility of delaying a

decision until more information is available (e.g., Fankhauser and Soare,

2013). Real option techniques are an extension of cost-benefit analysis

to capture this possibility and balance the costs and benefits of delaying

a decision (Arrow and Fisher, 1974; Henry, 1974). The benefits depend

on how much learning can take place over time. A key issue concerns

irreversible actions, such as the destruction of a unique environment

(Heal and Kristrom, 2003).

Application of cost-benefit or real option analysis requires evaluations

in monetary terms. For market impacts, prices may need to be corrected

for policies, monopoly power, or other external factors distorting market

prices (Squire and van der Tak, 1975). But a cost-benefit analysis also

often requires the valuation of non-market costs and benefits. This is

the case for impacts on public health, cultural heritage, environmental

quality and ecosystems, and distributional impacts. Valuation of non-

market impact is difficult because of values and preferences heterogeneity,

and subject to controversies—for example, on the value to attribute to

avoided death (see Viscusi and Aldy, 2003).

There has been progress in valuation of ecosystem services, as elaborated

in the Millennium Ecosystem Assessment (MEA, 2005), The Economics

of Ecosystems and Biodiversity (TEEB, 2010), and Bateman et al. (2011).

Two main categories of approaches have been developed: revealed and

stated preference methods. The latter is based on what people say about

their preferences, while the former uses their actual decisions (e.g., how

957

17

Economics of Adaptation Chapter 17

m

uch they pay for a house) and is often considered more accurate. Other

approaches include avoided or replacement cost, that is, measuring the

cost of providing the ecosystem service artificially. When local information

is not available, value transfer techniques can be applied moving

information from other locations. For example, Brander et al. (2012)

applies value transfer to climate change impacts on wetlands but

caution is required in making such transfers (National Research Council,

2005; Navrud and Ready, 2007).

Theoretically, cost-benefit approaches can account for distributional

impacts, for instance, through attribution of a higher weight to the poorest

(Harberger, 1984). Results are however highly dependent on preferences

that can be extremely heterogeneous and difficult to measure (Barsky

et al., 1997). As discussed in detail in Chapter 2, valuation and decision

making cannot be separated from the institutional and social contexts

(e.g., what is considered as a right). Yet, overall, as concluded by the IPCC

Special Report on Managing the Risks of Extreme Events and Disasters

to Advance Climate Change Adaptation (SREX), the applicability of

rigorous community-based adaptations (CBAs) for evaluations of

adaptation to climate variability and change may be limited (Handmer

et al., 2012).

17.3.2.2. Multi-Metric Decision Making for Adaptation

Multi-metric decision making provides a broader framework, which also

permits balancing among multiple, potentially competing objectives

(Keeney and Raiffa, 1993). This branch of decision analysis is also known

as multi-criterion analysis. Such an approach is helpful when decision

makers have difficulty in trading off different objectives (Martinez-Alier

et al., 1998). Using multiple criteria, decision makers can include a full

range of social, environmental, technical, and economic criteria—mainly

by quantifying and displaying trade-offs. Multi-criterion analyses have

been applied to adaptation issues including urban flood risk (Kubal et

al., 2009; Grafakos, 2012; Viguie and Hallegatte, 2012), agricultural

vulnerability (Julius and Scheraga, 2000), and choice of adaptation

options in the Netherlands (Brouwer and van Ek, 2004; de Bruin et al.,

2009a), Canada (Qin et al., 2008), and Africa (Smith and Lenhart, 1996).

The United Nations Framework Convention on Climate Change (UNFCCC)

developed guidelines for the adaptation assessment process in developing

countries in which it suggests the use of multi-criteria analysis (UNFCCC,

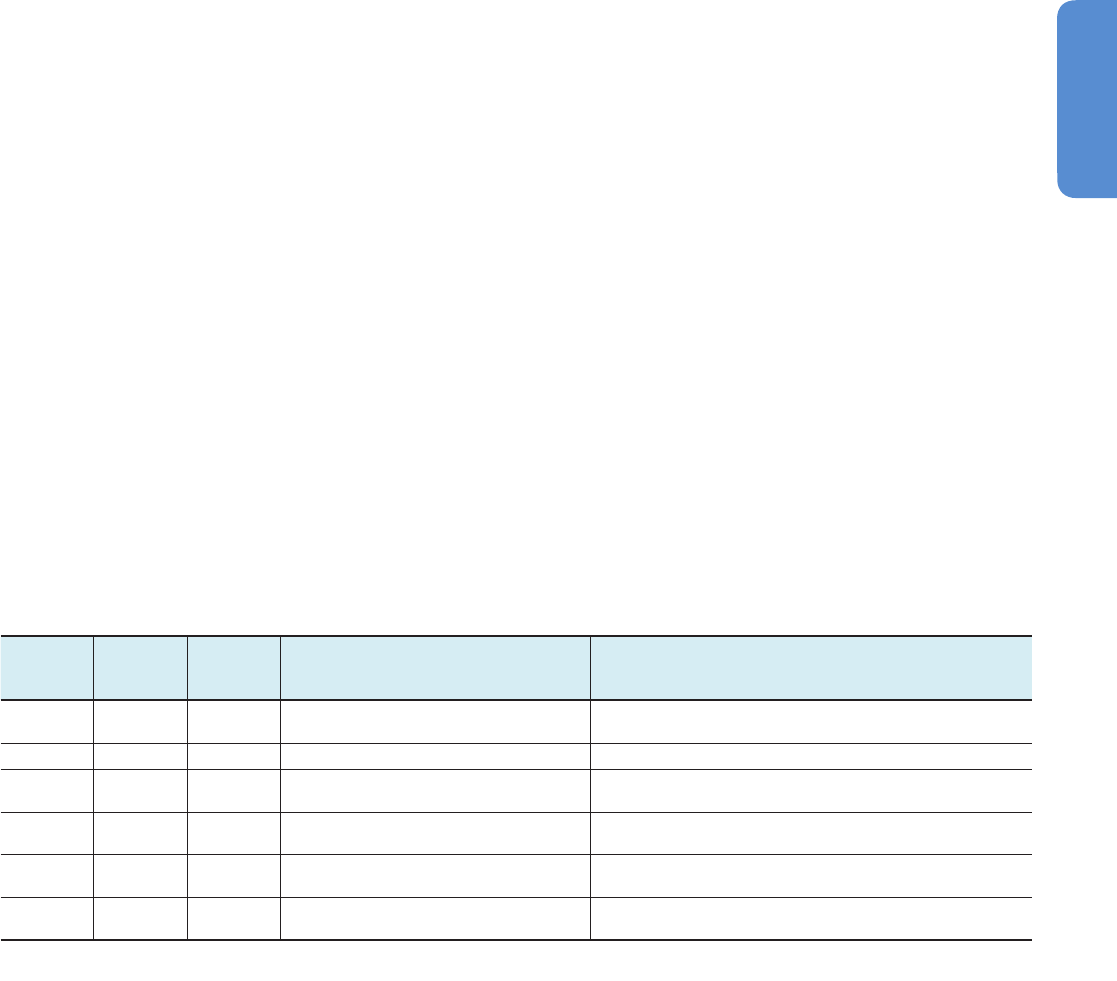

2002). As an illustration, Figure 17-3 shows a multi-criteria analysis of

three urban policies in the Paris agglomeration, using five policy objectives

and success indicators (climate change mitigation, adaptation and

risk management, natural area and biodiversity protection, housing

affordability, and policy neutrality).

17.3.2.3. Non-Probabilistic Methodologies

Cost-benefit analysis and related methods require probabilities for each

climate scenario. But in most cases, it may be impossible to define (or

to agree on) probabilities for alternative outcomes, or even to identify

the set of possible futures (including highly improbable events) (Henry

and Henry, 2002; Gilboa, 2010; Millner et al., 2010; Kunreuther et al.,

2012). This is especially true for low-probability, high-impact cases or

poorly understood risks (Weitzman, 2009; Kunreuther et al., 2012). In

such contexts, various approaches have been proposed (see reviews in

Ranger et al., 2010; Hallegatte et al., 2012; see also Chapter 2).

Scenario-based analyses study different policies in different scenarios

that try and cover the uncertainty space for key parameters (Schwartz,

1996). This is the approach followed by many climate change impact and

adaptation studies when using several IPCC Special Report on Emission

Scenarios (SRES) scenarios (Carter et al., 2001, 2007; Hallegatte et al.,

2011). Then, various methodologies or criteria can be used to make a

decision.

The maxi–min criterion suggests choosing the decision with the best

worst-case outcome and the mini–max regret criterion (Savage, 1951)

suggests choosing the decision with the smallest deviation from optimality

in any state of the world. Proposals for “no regrets” adaptation decisions

(Callaway and Hellmuth, 2007; Heltberg et al., 2009) employ such criteria.

Hybrid criteria balance between optimal and worst case performance

(Hurwicz, 1951; Aaheim and Bretteville, 2001; Froyn, 2005).

Another criterion is based on “robustness” and seeks decisions that

will perform well over a wide range of plausible climate futures,

socioeconomic trends, and other factors (Lempert and Schlesinger, 2000;

Lempert et al., 2006; Dessai and Hulme, 2007; Lempert and Collins,

2007; Groves et al., 2008; Wilby and Dessai, 2010; WUCA, 2010; Brown

et al., 2011; Lempert and Kalra, 2011). Instead of starting from a few

scenarios, these methods start with an option or a project and test it

under a large number of scenarios to identify its vulnerabilities to

uncertain parameters. Small adjustment or large changes in options or

projects can then be identified to minimize these vulnerabilities. Example

implementations include InfoGap, which has been used to inform

Climate change

mitigation

Policy neutrality

Adaptation and

natural risk reduction

Natural area and

biodiversity protection

Housing

affordability

Zoning policy to reduce the risk of flooding

Do-nothing scenario

Greenbelt policy

Public-transport subsidy

Figure 17-3 | Consequences of three policies in the Paris agglomeration: a greenbelt

policy, a public transport subsidy, and a zoning policy to reduce the risk of flooding,

measured using five different metrics representing five policy objectives. Axes

orientation is such that directions toward the exterior of the radar plot represent

positive outcomes (Viguié and Hallegatte, 2012).

958

Chapter 17 Economics of Adaptation

17

a

daptation decisions in water management (Ben-Haim, 2001; Korteling

et al., 2013); RDM (robust decision making), which has been used for

water management and flood risk management planning (Lempert et al.,

2003; Lempert and Groves, 2010; Lempert and Kalra, 2011; Matrosov et

al., 2013); and robust control optimization (Hansen and Sargent, 2008).

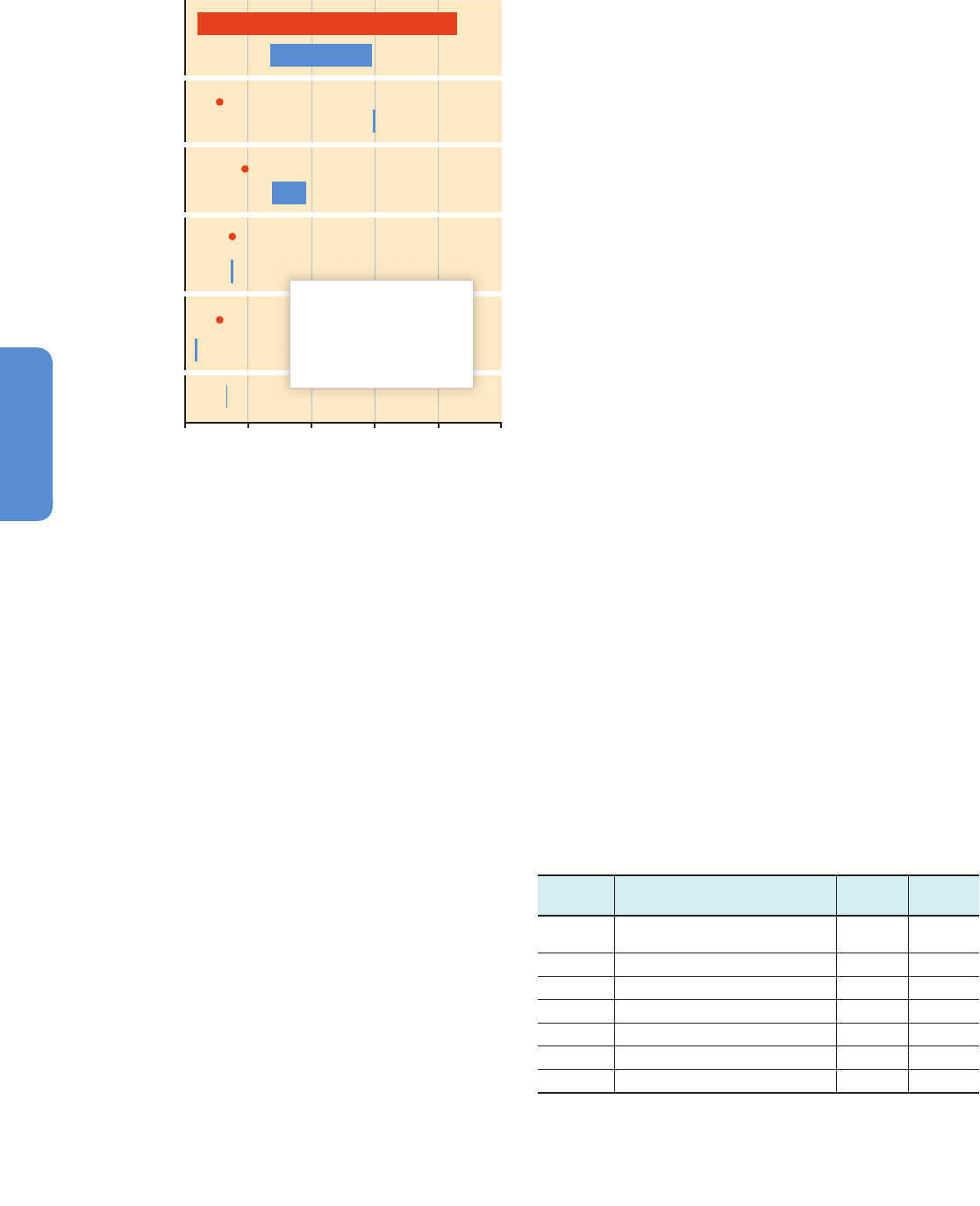

Figure 17-4 illustrates the application of robust decision making on

flood risks in Ho Chi Minh City (Lempert et al., 2013). The analysis

examined different risk management portfolios (including, for instance,

raising homes and retreat). Each portfolio was simulated in 1000

scenarios, covering socioeconomic and climate uncertainty. The RDM

analysis found that the current plan is robust to a wide range of possible

future population and economic trends. But it would keep risk below

current levels only if rainfall intensities increase by no more than 5%

and if the Saigon River rises less than 45 cm. Additional measures were

found that made the situation robust for increases in rainfall intensity of

up to 35% and increases in the level of the Saigon River of up to 100 cm.

17.4. Costing Adaptation

Interest in estimating the costs of adaptation has grown as the need

for action has become clearer. The literature focuses on two levels of

costing: global scale estimates, largely to assess the overall need for

adaptation finance funds; and regional and local-scale estimates, often

limited to a particular vulnerable economic sector, which may be applied

to inform budgeting or to support adaptation decision making, or

to allocate scarce resources among the best prospects for effective

a

daptation. The methods for these two types of studies vary widely, but

for the important methodological considerations for costing adaptation

are similar for both types.

17.4.1. Methodological Considerations

1

7.4.1.1. Data Quality and Quantity

There is very little discussion of data gaps related to assessing the

benefits of adaptation, but poor or sparse data obviously limit the

accuracy of these estimates. Callaway (2004) suggests that a major

challenge is the low quality and limited nature of data, especially in many

developing countries, and notes many transactions are not reported

because they occur in informal economies and social networks. In a more

general setting Hughes et al. (2010) note that historical weather data

are not typically sufficiently detailed while others note sparse data on

costs of adaptation actions. For example, Bjarnadottie et al. (2011) note

incomplete and contradictory data on house retrofit costs for hurricane

protection. Also there are simply missing non-market data on such items

as the value of ecosystem services (Agrawala and Fankhauser, 2008),

particularly as affected by climate and possible adaptation.

17.4.1.2. Costs and Benefits Are Location-Specific

Calculating localized impacts requires detailed geographical knowledge

of climate change impacts, but these are a major source of uncertainty

Rainwater

(10%,100 cm)

Relocate

(17%,100 cm)

All options

(32%,100 cm)

Elevate and relocate with adaptive

groundwater and rainwater

(26%, 100 cm)

Elevate and relocate

(21%, 85 cm)

Groundwater and

rainwater with adaptive

elevate and relocate

(17%, 100 cm)

Groundwater and

rainwater

(17%, 100 cm)

NOAA SLR estimate with

continued subsidence (75 cm)

Groundwater

(7%,55 cm)

Baseline

(6%,55 cm)

Elevate

(23%,55 cm)

MONRE SLR estimate (30 cm)

IPCC SREX

mid value (20%)

IPCC SREX

high value (35%)

10

20

30

40

50

60

70

80

90

100

110

0

0% 5% 10% 10% 20% 25% 30% 35% 40% 45% 50% 55% 60%

Percent increase in rainfall intensity

Increase in Saigon River levels (cm)

Figure 17-4 | Various risk management strategies in Ho Chi Minh City, and their robustness to increases in river levels and rainfall intensity. Different options can cope with

different amplitudes of environmental change (Lempert et al., 2013).

959

17

Economics of Adaptation Chapter 17

in climate models (see Refsgaard et al., 2013). Global estimates of

adaptation cost are generally not grounded in local-scale physical

attributes important for adaptation, which in part explains why local

and regional-scale adaptation cost estimates are not consistent with

global estimates (Agrawala and Fankhauser, 2008). Compared with

developed countries, there is also a limited understanding of the potential

market sector impacts of climate change in developing countries.

17.4.1.3. Costs and Benefits Depend on Socioeconomics

It is sometimes assumed that climate will change but society will not

(Pielke, 2007; Hallegatte et al., 2011; Mechler and Bouwer, 2013). Future

development paths affect climate change impact estimates, and can alter

estimates from positive to negative impacts or vice versa. Some studies

show higher growth rates raise hurricane vulnerability (Bjarnadottir,

2011). On the other hand, higher incomes allow the funding of risk-

reducing policies.

17.4.1.4. Discount Rates Matter

Because adaptation costs and consequences occur over time, discount

rates are a core question. Opinions vary sharply on this question (Baum,

2009; Heal 2009). Hof et al. (2010) notes that a low discount rate is

needed for distant future climate change to matter. A low discount rate

is the primary reason for the relatively high estimates of climate damage

in the Stern Review (Stern, 2006). For climate adaptation projects, the

social or consumption discount rate is the relevant one (Heal, 2009).

The rates used fall between 0.1 and 2.5%, although without good

arguments for specific values (see Heal, 2009). Nordhaus (2008) chooses

a value of 1.5% while Stern uses a much lower value of 0.1%. Nordhaus

emphasizes consistency with the rate of return on investment as a driving

rationale while Stern points to ethical issues. Allowing environmental

services to enter consumption can change the social discount rate

substantially and generate a low or even negative social discount rate

(Guesnerie, 2004; Sterner and Persson, 2007; Heal, 2009). The UK

Treasury now mandates the use of declining discount rates for long-

term projects, as suggested by behavioral studies and by theoretical

analysis (Arrow et al., 2012).

17.4.2. Review of Existing Global Estimates:

Gaps and Limitations

There has been a limited number of global and regional adaptation cost

assessments over the last few years (Stern, 2006; World Bank, 2006,

2010a; Oxfam, 2007; UNDP, 2007; UNFCCC, 2007, 2008). These estimates

exhibit a large range and have been completed mostly for developing

countries. The most recent and most comprehensive to date global

adaptation costs range from US$70 to more than US$100 billion annually

by 2050 (World Bank, 2010a; see Table 17-2).

IPCC (2012) considers confidence in these numbers to be low because

the estimates are derived from only three relatively independent lines

of evidence. World Bank (2006) estimates the cost of climate proofing

foreign direct investments (FDI), gross domestic investments (GDI), and

Official Development Assistance (ODA), as does the Stern Review (2006),

Oxfam (2007), and UNDP (2007). UNFCCC (2007) calculated existing and

planned investment and financial flows (I&FF), and then estimated the

additional investment required for adaptation as a premium on existing

and planned investments. The World Bank (2010a) followed the UNFCCC

(2007) methodology of estimating the premium climate change imposes

on a baseline of existing and planned investment, but included more

extensive modeling (as opposed to developing unit cost estimates),

constructed marginal cost curves and climate stressor-response functions

for adaptation actions, and included maintenance and coastal port

upgrading costs.

Given their common approaches these estimates are interlinked, which

explains the seeming convergence of their estimates in later years, as

discussed by Parry et al. (2009). However, there are important differences

in terms of sectoral estimates, as Figure 17-5 shows in comparing the

UNFCCC (2007) and World Bank (2010a) studies. Extreme events, a

potential source of large adaptation costs, are not properly covered,